President Trump makes major economic announcement

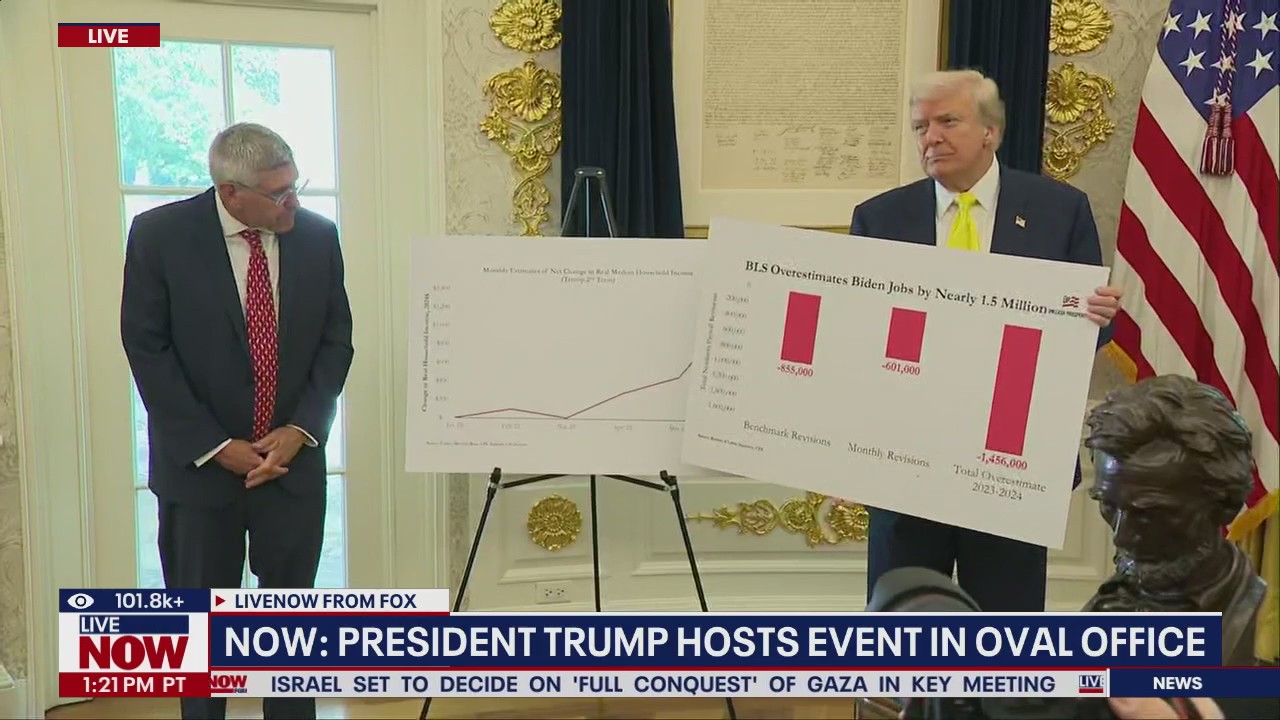

President Trump called reporters into the Oval Office to make a “major” economic announcement. President Trump presented new economic data alongside Stephen Moore from the Heritage Foundation.

LOS ANGELES – President Donald Trump signed an executive order Thursday that could open up 401(k) retirement accounts to investments like private equity, real estate, cryptocurrency, and other alternative assets.

The order directs the Department of Labor to work with the Treasury Department, the Securities and Exchange Commission, and other regulators to revisit previous guidance on alternative investments in defined-contribution retirement plans. The change could give asset managers new access to a $12 trillion market traditionally limited to stocks, bonds, and cash.

Critics warn the move could introduce more risk, higher fees, and less transparency into retirement savings. Proponents argue younger investors could benefit from potentially higher returns in funds that gradually shift to safer assets as they near retirement.

What Trump’s order would do

The White House summary of the order says the SEC must consider ways to “facilitate access to alternative asset investments” for 401(k) participants.

Big private equity firms like Blackstone, KKR, and Apollo Global Management — along with asset managers such as BlackRock — could stand to gain by expanding into retirement plans. BlackRock has already announced plans to launch a retirement fund next year that includes private equity and private credit investments.

Morningstar analyst Jason Kephart said the order represents “a lot of opportunity” for asset managers but raised concerns for individual investors. “That’s where it’s less clear after all the additional fees, the additional complexity, and less transparency,” Kephart said.

What we know:

The order marks a significant policy shift toward allowing riskier, less liquid investments in mainstream retirement plans. Supporters say the change could help long-term investors diversify their holdings and potentially earn higher returns over decades of saving.

- The order would allow retirement accounts to invest in assets that are generally harder to sell quickly and carry higher fees than publicly traded stocks and bonds.

- The Department of Labor issued limited guidance on private equity in 401(k) plans during Trump’s first term, but few plans took advantage due to litigation concerns.

- The move could also expand access to cryptocurrency in retirement plans, which Trump has supported.

What we don’t know:

The timeline for implementing these changes remains uncertain, and there are questions about whether regulatory safeguards will be strong enough to protect less experienced investors.

Adoption will likely depend on both market appetite and legal clarity from regulators.

- How quickly regulators will act on the order.

- Whether litigation risks or regulatory changes will limit adoption.

- The specific safeguards that will be put in place to protect investors.

The backstory:

Private equity firms are seeking new funding sources after high interest rates disrupted their buy-and-sell business model. Some industry executives say legal reforms may be needed before they fully enter the 401(k) market.

BlackRock CEO Larry Fink acknowledged the potential for lawsuits, calling analytics and data “imperative way beyond just the inclusion” of alternative assets in retirement funds.

Democratic Senator Elizabeth Warren has raised concerns about the sector’s “weak investor protections” and “expensive management fees,” questioning how savers will be protected if plans take on more complex investments.

The Source: This report is based on information from the White House, the Department of Labor, the Securities and Exchange Commission, and interviews with market analysts. Additional material came from Morningstar, BlackRock, and public statements from U.S. lawmakers.